Crude oil prices pared gains in early Asia trade Monday as traders took profit after a strong rally last week on signs that the global oil glut might start to ease in the coming months.

On the New York Mercantile Exchange, light, sweet crude futures for delivery in June CLM6, -1.21 per cent traded at $43.34 a barrel, down $0.38, or 0.8 per cent in the Globex electronic session. June Brent crude LCOM6, -0.95per cent on London’s ICE Futures exchange fell $0.32, or 0.7 per cent, to $44.79 a barrel.

Prices are down on profit taking. Without any major news or catalysts, prices are going to see-saw in the near term,” said Gao Jian, an oil analyst at Shandong-based SCI International.

In the absence of a production-freeze deal between Russia and the Organisation of the Petroleum Exporting Countries, oil prices still rose by nearly 5 per cent last week, underpinned by hopes that declining production in non-OPEC countries would help moderate the surplus in the market.

The International Energy Agency expects waning output from the U.S., China, Russia, Mexico, and Colombia to reset the supply-and-demand balance next year and that prices will gradually pick up in 2018.

Analysts at Bernstein Research paint a more optimistic picture, estimating a rebalance by the second half of this year as prolonged low prices stimulate more demand.

“As inventories start to drop, this should push prices towards the marginal cost of production,” said Neil Beveridge, senior analyst at the firm.

The firm believes a $60-a-barrel oil price is required to balance the market over the longer term.

On the demand side, China’s slowing economy and the rise of renewable energy pose headwinds, but demand growth for oil is still expected. The IEA forecasts global oil-demand growth to moderate to around 1.2m barrels a day in 2016, slower than the 1.8m-barrels-a-day expansion last year.

This week, traders will be eyeing the Federal Reserve policy meeting on Wednesday for an outlook on the U.S. economy. The market largely expects the committee to keep the benchmark rate unchanged. The Energy Information Administration will also release weekly U.S. crude inventories and production data for the week ended April 22 on Wednesday.

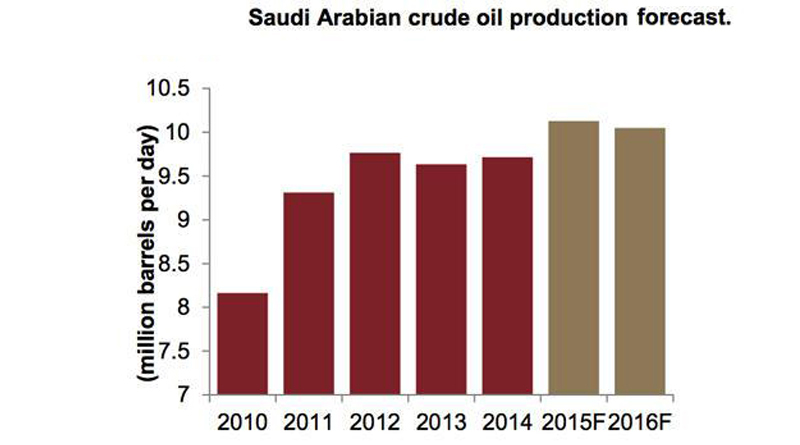

For Monday, investors will also be looking out for major oil produce, Saudi Arabia to announce a plan to reduce the country’s reliance on oil, via Deputy Crown Prince Mohammed bin Salman’s “Vision 2030.” Included will be a National Transformation Plan, which will lay out asset sales, spending cuts and tax hikes.

Nymex reformulated gasoline blendstock for May RBK6, -1.15 per cent — the benchmark gasoline contract — fell 119 points to $1.5190 a gallon, while May diesel traded at $1.2991, 98 points lower.

ICE gasoil for May changed hands at $389.00 a metric ton, down $6.75 from Friday’s settlement. – Reuters