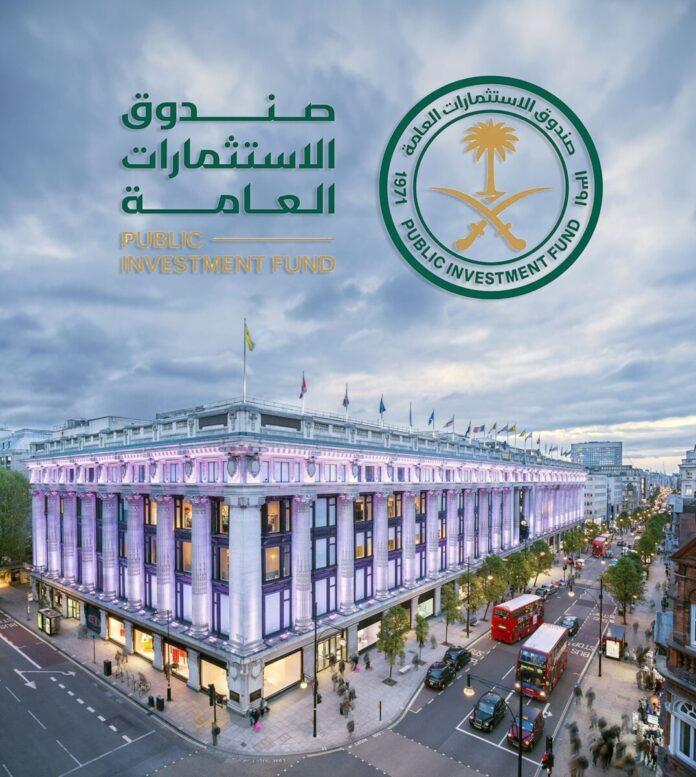

The Saudi Public Investment Fund (PIF) has purchased a 40% stake in Selfridges, an iconic British department store, as part of its ongoing strategy to invest in prominent global assets. The remaining ownership remains with Central Group, a Thai conglomerate that gained full control after Signa Group, its original partner, filed for insolvency. The financial details of the deal have not been disclosed.

Founded in 1909 by American entrepreneur Harry Gordon Selfridge, Selfridges quickly became a retail trailblazer with its flagship store on London’s Oxford Street. Known for its innovative window displays and themed shopping experiences, it has been named the world’s best department store four times. Over the years, Selfridges expanded its reach, incorporating De Bijenkorf in the Netherlands and Brown Thomas and Arnotts in Ireland, along with additional locations in the UK.

Initially owned by the Canadian Weston family for nearly two decades, Selfridges was sold for £4 billion in 2021. The acquisition by PIF reflects its aim to diversify its economic portfolio beyond oil through investments in sectors like retail and sports.

This latest investment by PIF adds to its portfolio of high-profile assets worldwide. Despite the global & specifically UK’s economic challenges, Selfridges remains a top destination, revered for its luxury offerings and cultural significance.