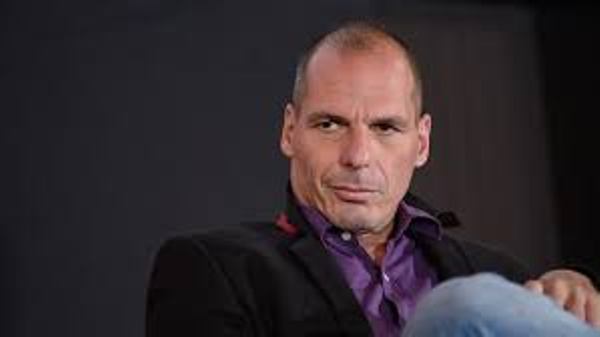

As the Greek increased Taxes, Former Greek Finance Minister Yanis Varoufakis has told the BBC that economic reforms imposed on his country by creditors are “going to fail”, ahead of talks on a huge bailout.

Mr Varoufakis said Greece was subject to a programme that will “go down in history as the greatest disaster of macroeconomic management ever”. The German parliament approved the opening of negotiations on Friday.

The bailout could total €86bn (£60bn) in exchange for austerity measures.

In a damning assessment, Mr Varoufakis told the BBC’s Mark Lobel: “This programme is going to fail whoever undertakes its implementation.”

Mr Varoufakis resigned earlier this month, in what was widely seen as a conciliatory gesture towards the eurozone finance ministers with whom he had clashed frequently.

He said Greek Prime Minister Alexis Tsipras, who has admitted that he does not believe in the bailout, had little option but to sign.

Mr Tsipras has announced a cabinet reshuffle, sacking several ministers who voted against the reforms in parliament this week.

As a result, BBC correspondent says, Mr Tsipras will preside over ministers who, like himself, harbour serious doubts about the reform programme.

Greece must pass further reforms on Wednesday next week to secure the bailout. Germany was the last of the eurozone countries needing parliamentary approval to begin the talks.

But the head of the Eurogroup of finance ministers, Jeroen Dijsselbloem has warned that the process will not be easy, saying he expected the negotiations to take four weeks.

Some Greek banks reopened Monday following weeks of closures, after the European Central Bank (ECB) raised the level of emergency funding available.

Separately, the European Council approved the €7bn bridging loan for Greece from an EU-wide emergency fund. The loan was approved in principle by eurozone ministers on Thursday and now has the go-ahead from all non-euro states.

It means Greece will now be able to repay debts to two of its creditors, the ECB and International Monetary Fund (IMF).