Inflation has fallen … What Does that mean?

Annual general inflation

Annual general inflation compares prices in November 2017, for example, with its equivalent in 2016. In order to lower prices, the general annual inflation index ratio should be negative. As long as the ratio is above zero or positive, prices are still rising, compared to the same month last year. But if the ratio has fallen from, the rise in prices has become slower and has started moving towards stability.

For example, a commodity priced at five Egyptian pounds in November 2016; after the floatation of the Egyptian pound, inflation spiked and the commodity’s price rose to 10 pounds; but as inflation has declined, the price has dropped to EGP 8.50. Whilst this is still above the pre-floatation price, it shows progress.

When could the price be less than EGP 5.00?

When inflation is below zero; however, this is not possible and it will not happen in the case of Egypt for various reasons.

- A continued increase in consumption rates of food, drink and commodities

- Egypt imports most of its food and raw materials incorporated into its industry

- Traders and manufacturers were importing with an exchange rate of one Dollar to EGP 8.80; yet after floatation of the Egyptian pound, the value of one dollar became approximately EGP 18.00. It is therefore impossible for prices to return to their previous levels, only if the exchange rate falls below 8.80, which is unlikely to occur in the short or medium term.

- Traders and manufacturers were transporting their goods at a cost of 235 piasters per litre of diesel, but now the price of a litre is 365 piasters. Accordingly, the price of transport remains a dominant factor for local industries and increases in commodities’ prices.

- The same also applies to electricity, water and gas prices, which increased after the lifting of the partial government subsidies.

Monthly inflation

Monthly inflation is the comparison of commodity prices in a particular month against the preceding month, for example comparing prices in November 2017 with prices in October 2017.

- Monthly inflation in November for selected food and beverage prices, reached a negative 0.06% rate, meaning the price of food and drink has decreased in November compared to the previous month. This marks the first decline since January 2016.

- But if we compare November 2016 to November 2017 we will find that prices are still higher, which means that prices will not return to their levels of November 2016 before the liberalization of exchange. The following curve explains the monthly and annual changes in the index of food and drink.

- Lower prices on a monthly basis compared to October 2017: The cost of vegetables decreased by 3.1%, because tomatoes dropped by 6.7%, zucchini 15.7% and green beans 24.8%. The cost of meat and poultry also dropped by 1% due to a 3.1% drop in poultry prices and a 2.6% reduction in egg prices.

- The products with higher prices on a monthly basis compared to October 2017 were full-fat milk (8.2%), Margarine (0.7%), sesame paste (9.8%) and sweets (14.1%).

- In general, the cost of food and drink declined by 0.06%.

What does the general annual inflation drop mean and why is it positive?

- This is the first major drop to occur since the pound’s floatation and it is the biggest annual decline since 2011.

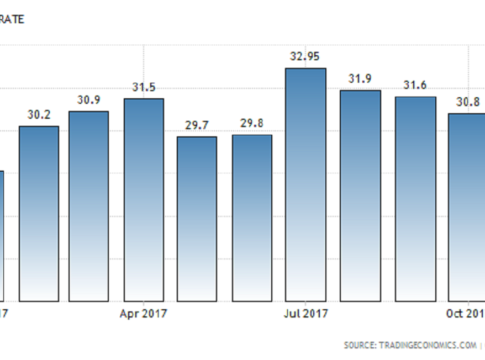

- In July last year, when we were at the peak of a 35% inflation, we were ranked sixth globally in terms of the highest inflation rates; now, we are in ninth place.

- High inflation gives a negative signal to the world regarding the country’s economy, moving towards lower inflation rates means it is the perfect time for investors to venture into the market for positive returns on their investments.

- Lowering inflation paves the road for an interest rate cut. Currently, Egypt is ranked eighth in the world for high interest rates.

5 – The monetary easing policy is expected to start with the green light given from lower inflation rates. Leading to Cash facilitation, which means increasing the supply of funds and reducing interest rates, and accordingly cost of borrowing decreases. Accordingly, the cost of investment and borrowing for the establishment of projects decreases thus boosting investment and increasing employment opportunities while reducing unemployment and raising economic growth. The Central Bank of Egypt is responsible for setting the monetary policy and accordingly interest rates.

It is important to follow Bloomberg›s coverage of this news

Bloomberg reported that the Egyptian economy is recovering; with inflation rates declining and investments increasing and the shock of currency liberalization fading, the central bank is moving towards a rate cut in 2018.

https://www.bloomberg.com/news/articles/2017-12-10/egypt-annual-inflation-rate-slows-as-currency-effects-fade

Based on the above, we expect the following:

- The growth rate is above 5%, the unemployment rate remains below 12% and the lending rate is higher than 50%.

- Closing the door for deposit of funds in certificates at the high return of 16% and 20%

- In concurrence with the start of Zahr field’s production and the gradual recovery of regular tourism, we expect a further rise in the balance of payment surplus.

- We expect, with lower borrowing costs, a rise in domestic production, to replace imported products to grow at a faster pace. Thus, the trade balance deficit is likely to continue declining by as much as 50%.

- With the high pace of business activity and domestic and foreign investment, we expect the country›s tax and non-tax revenues to rise.

- In line with the continued control of public spending, we are very likely to decrease the budget deficit to below 10% during the current fiscal year.

These developments prove that the Egyptian economy is moving towards more recovery, stability and improvement, albeit slowly, provided the stability of other factors such as:

- Political stability along with the continued progress of economic reforms

- Improved security services and shrinking the scope and impact of terrorist operations

- Stability of relations with the most important trading partners (Gulf states, Europe and China)

- Stability of the security situation in Libya

- The success of the Palestinian reconciliation and its positive impact on border security in northern Sinai

- The completion, perseverance and seriousness of the government in carrying out the required economic reforms

- Continued measures against corruption monopoly and inefficient bureaucracy

Till when will we continue to cut subsidies?

Subsidies cover 32 aspects that account for one-third of the general budget. It is wrong to say that we are trying to reduce or cancel all of the subsidies, as the target is to cut subsidies or cancel them only on certain items. In order to re-direct expenditures towards other items, for example, we cancel subsidies on electricity and direct expenditure towards the supply of goods. The ultimate purpose of reorganising these items is to ensure that the beneficiaries really need them and deserve to enjoy them and ensure that these features are not randomly distributed like in the past. Under the government’s plan, it is assumed that we will complete the reform programme by 2020

As long as prices will not return to previous years, what is the solution that balances the equation?

Firstly, price stability is the beginning, in the sense that the rise does not continue indefinitely. Secondly, high income is the next step and it will be attained by achieving the following:

- When we lower the interest rate, the cost of borrowing decreases, it encourages investment, it needs more workers, and unemployment is reduced.

- Also, when interest rates fall, individuals and companies stop depositing their money into banks for lower returns. These funds are then directed to the market and invested in projects and production. Demand increases and supply increases. Population growth continues and society adapts and with the new situation, consumption rises and incomes gradually rise.

- With radical legislative reforms, such as the Investment, Bankruptcy, Exemption and Industrial Licensing Act, investors will keep pumping more cash into the market.

- Focus on the SME sector, start-up companies and entrepreneurship, so the government itself established a venture capital firm to invest in start-ups.

- Continuing the completion of national projects especially in the infrastructure sector. Without infrastructure, we will not move one step forwards, either in attracting investment or raising our production capacity. Therefore development of roads, new cities, airports and other projects are necessary to sustain the economy’s development

- To reduce the size of the informal sector in the economy but to continue to include it using all possible incentives

- Tax revenues lost in the informal sector were estimated at 400 billion pounds. This is equivalent to half of the official economy, between 1.8 to 2 trillion pounds, which needs re-evaluation to either deliver returns or eliminate factors that may impede business development by the current formal sector.

Based on the above, we believe that this is the end of the monetary and fiscal policy of deflation. The shift from the restriction of the economy to stimulating growth has come; this is a very different stage from the past in which we expect higher and rapid growth rates, as we are close to eliminating the economic crisis.