In this issue we discuss the following:

1. What are Egypt’s dollar resources?

2. Tourism figures in Egypt before the revolution

3. Egypt’s position in the World and the form of competition in the region

4. Tourism figures in Egypt after the revolution

5. The results of the Russian Metrojet airliner crash in the Sinai Peninsula

6. The beginning of recovery and the return of hopes

7. Reasons for growth in numbers and revenues

8. Diversification of tourism income sources

9. The latest developments in the tourism sector in Egypt

Egypt’s Dollar resources

When we talk about resources, we are referring to foreign currency (represented by the Dollar) revenues attained by an economy from its various sectors. The importance of revenues in foreign currency is that; it is used to repay foreign liabilities such as debt, bonds, deposits and grants, which are usually in foreign currency and not the local currency. We also use these resources to import our main needs such as wheat, fuel, gas, production inputs, etc. We cannot import in Egyptian pounds so it is necessary to have sources of income in foreign currency to carry out our dealings with foreign countries.

These resources for any country usually come from specific and semi-fixed sectors: national exports + foreign investments + expatriate remittances + tourism. In Egypt we have to add to the four previous sources: The Suez Canal revenues. With these five sources we can identify the dollars flow into Egypt, and from here we will tackle changes and developments experienced by the tourism sector as a predominant dollar resource for the Egyptian state.

First: The history of the revenues and statistics of tourism in Egypt and the world

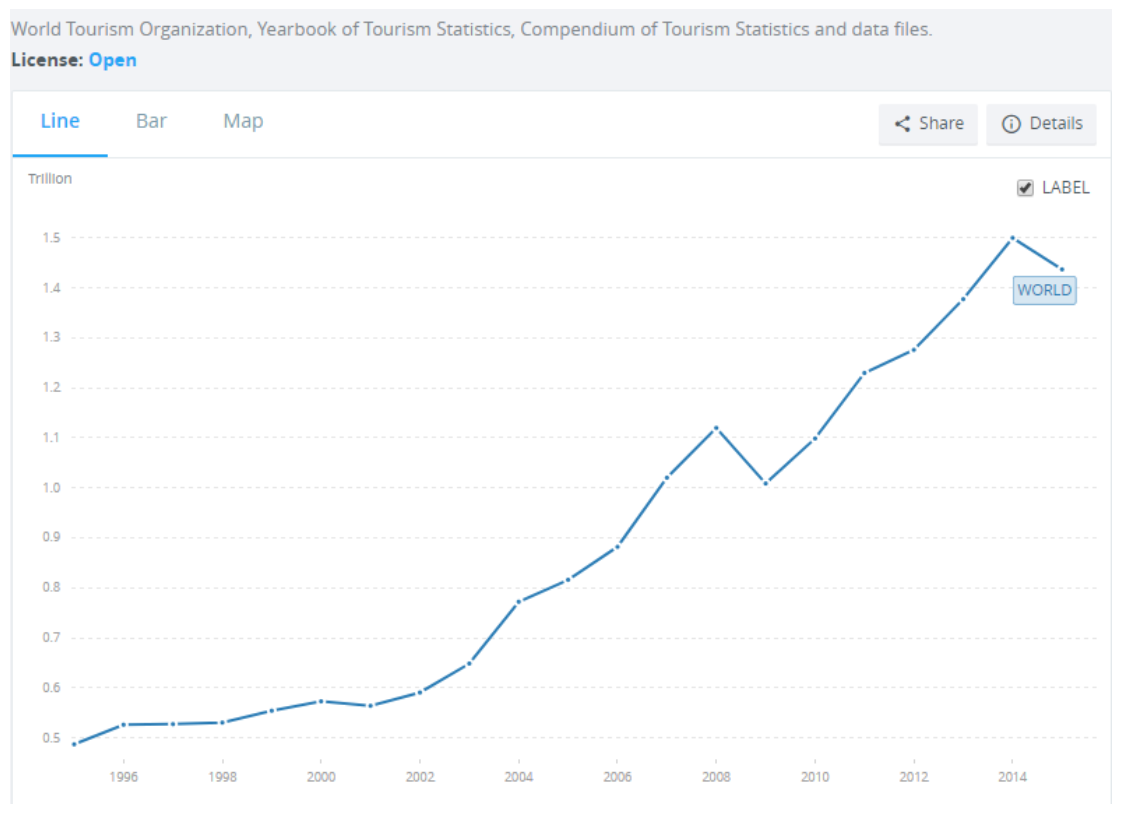

According to the World Tourism Organisation (WTO), the world’s countries are annually making $1.4 trillion from tourism.

Second: Tourism figures in Egypt before the revolution

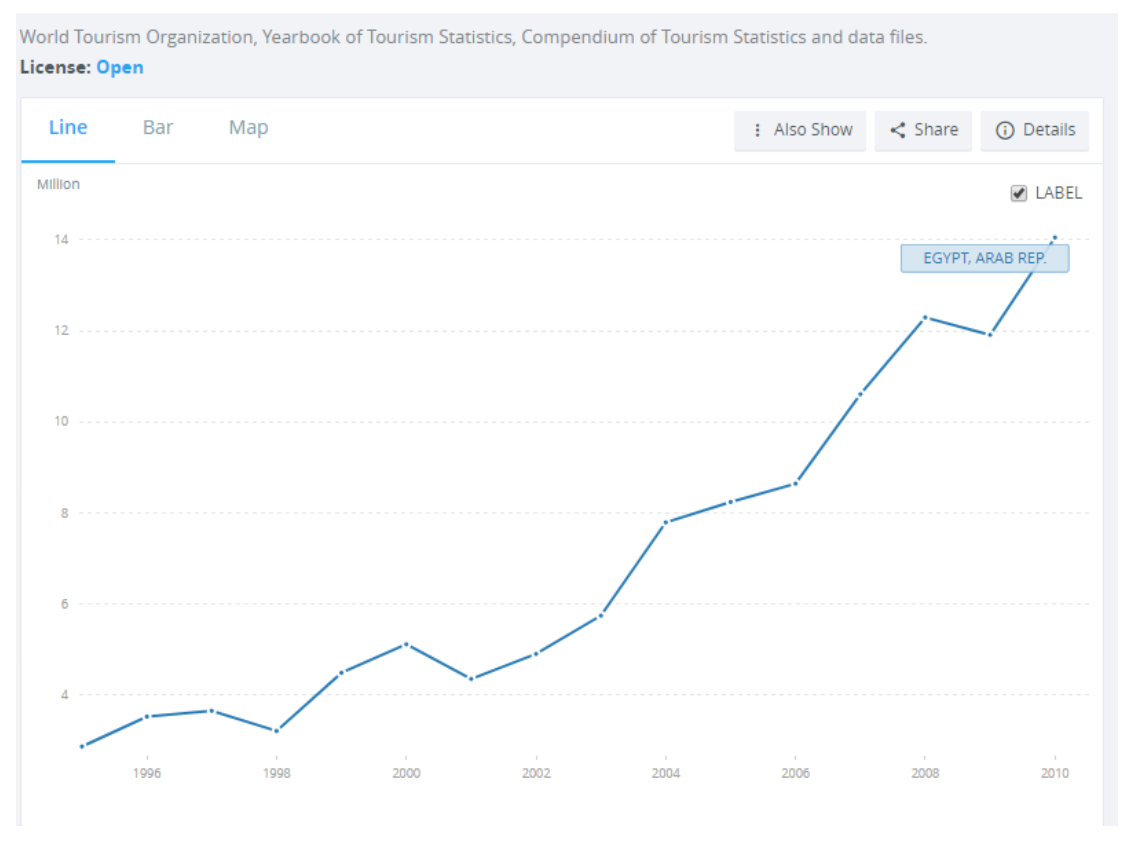

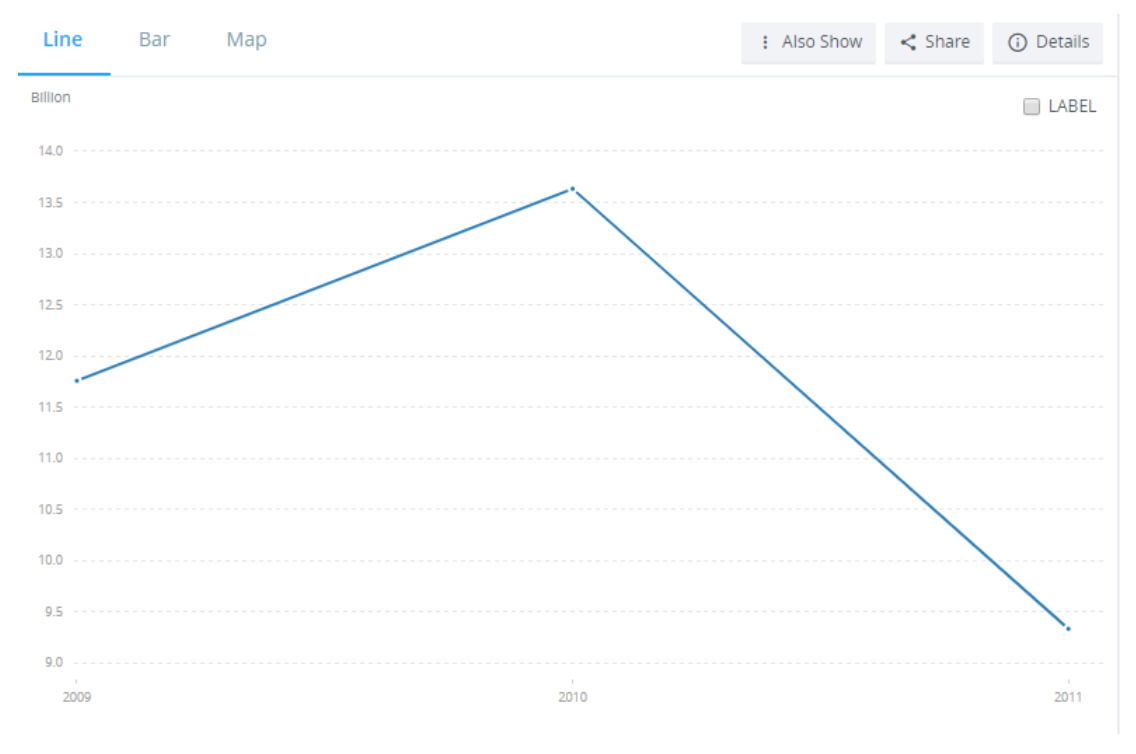

Egypt’s share, until 2010 (just before the revolution), had been approximately $13.5 billion.

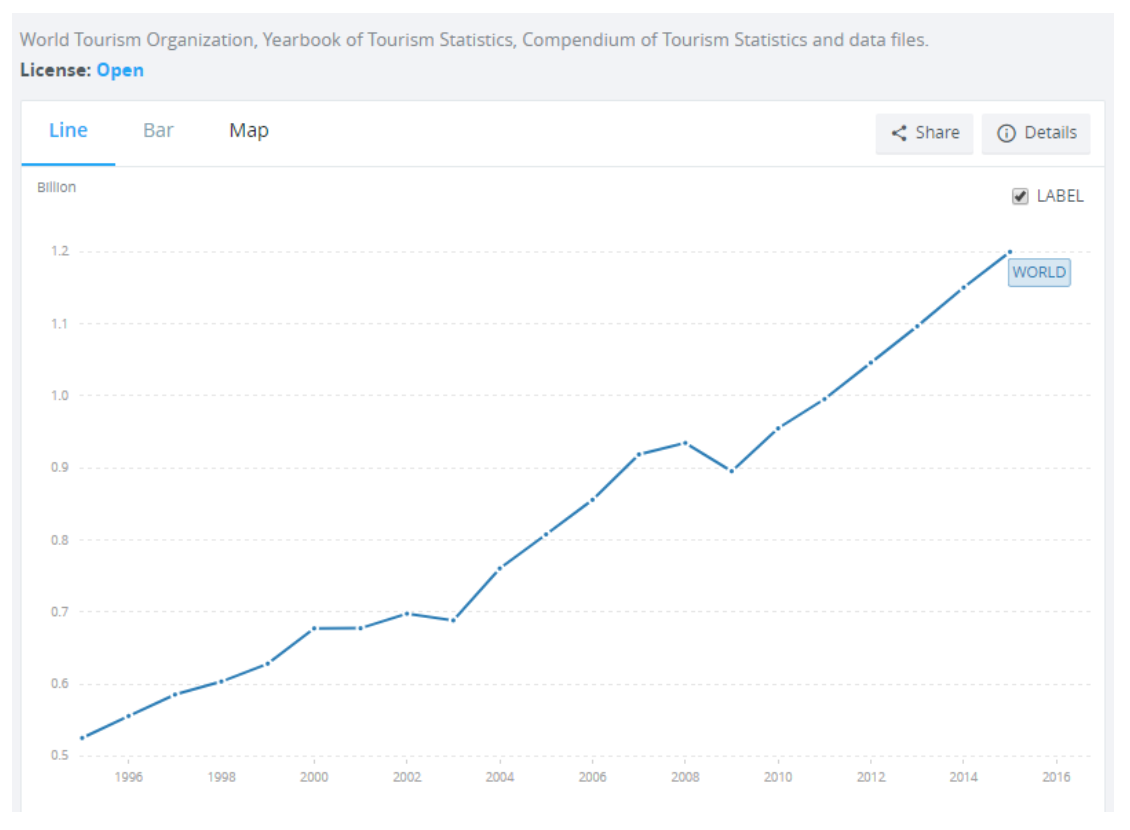

In terms of people, global tourism is estimated at about 1.2 billion foreign tourists traveling around the globe per year.

Until 201, Egypt had been approaching 14 million tourists a year.

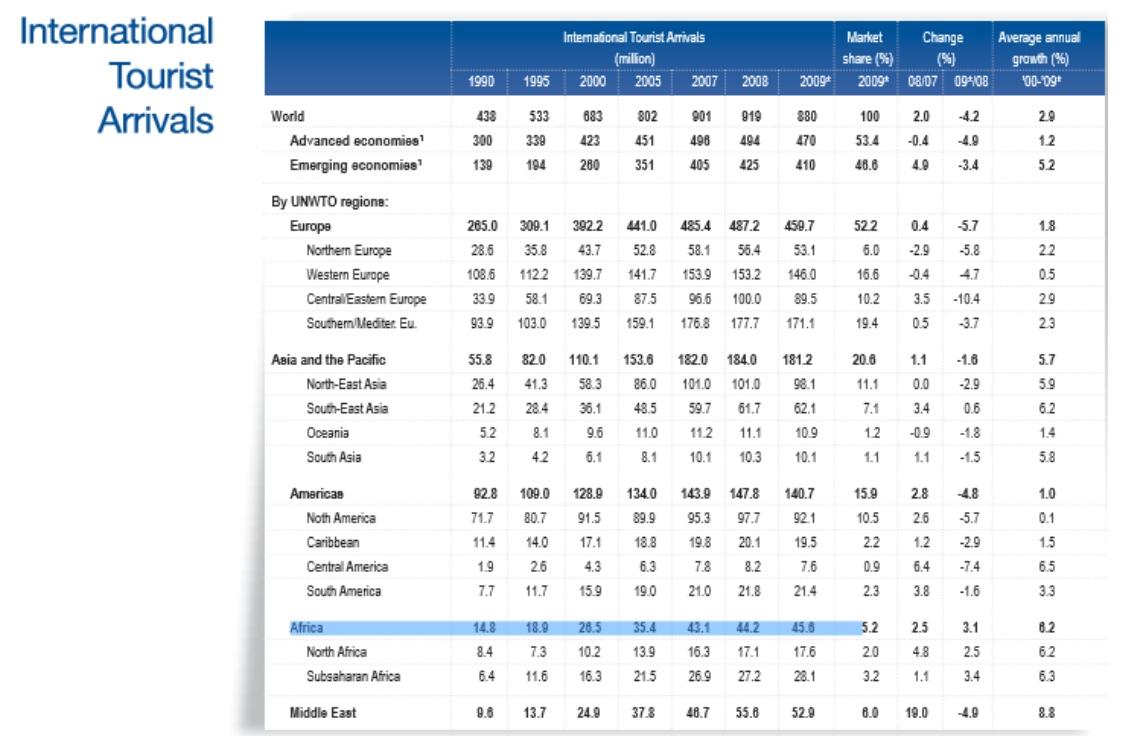

Up until 2010, there had been about 45 million tourists visiting Africa annually. Egypt accounted for one-third of this figure alone, according to the WTO report at the time. With the North African countries, excluding Egypt, receiving 3 million tourists a year and Egypt alone receiving 14 million tourists annually.

The expected growth rate of the number of tourists in Egypt, according to the organisation, before the outbreak of the revolution during the period from 1995 to 2020 was about 7.4%, exceeding the rate of growth in the Middle East and the world. Further more, Egypt was among the Top 20 tourist destinations in the world; the rankings in 2010 were as follows:

1. France

2. USA

3. China

4. Spain

5. Italy

6. UK

7. Turkey

8. Germany

9. Malaysia

10. Mexico

11. Russia

12. Ukraine

13. Austria

14. Greece

15. Poland

16. Hong Kong

17. Thailand

18. Egypt

19. Canada

20. Saudi Arabia (Hajj and Umrah)

Third: Tourism figures in Egypt after the revolution

After January 25, the chaos began to spread throughout the country. Security forces withdrew and accordingly security collapsed, companies were closed, the streets were stripped out of the security elements and the national committees spread out safeguarding their communities.

Number of tourists

Revenue

After reaching 14 million tourists with $13.5 billion of revenues in 2010, the figures fell to 9.5 million tourists with $9.3 billion of revenues after the revolution, a decline of about 30%. It was regarded as the worst tourism decline in Egypt’s history and, as if the state was at war, we stayed with these figures until 2014, when figures shifted to 9.5 million tourists with $6.8 billion dollars of revenues.

There was great hope that the tourism sector would recover as the political and security situation gradually developed. However, the disaster of the Russian Metrojet airliner crash in the Sinai Peninsula came at the end of this disastrous year to kill hopes of a near recovery. Russia and the United Kingdom, two of the most important tourism markets for Egypt, announced thereafter their decision to ban flights to Sharm El-Sheikh. Causing deterioration to the sector’s revenues. Until 2016, the disappointing numbers continued, with figures dropping from 9.5 million tourists to fewer than 5.3 million. Revenue fell from $6.8 billion to less than $3.4 billion in a drop that exceeded that in 2011, with a 50% decline in revenue.

The minimum amount of dollar income lost due to these disturbances from 2011 to 2017 is equivalent to $42 billion, which is more than three time the amount of the IMF loan.

Fourth: the emergence of hope

We began to see light at the end of the tunnel when the Egyptian political leadership and the economic team took the most important decision in the history of the Egyptian economy to liberalize the exchange rate. The weakness of the local currency had its negative and positive impact. The Negative impact, lead to increased debt cost, import cost and prices. The Positive Impact, lead to Increase in tourism revenues, investment attractiveness and export incentives.

What is the relationship between the exchange rate and tourism revenues?

The equation is simple and consists of two parts:

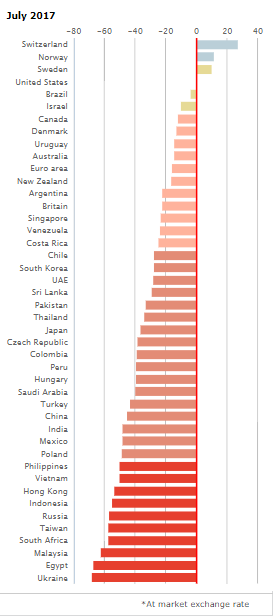

First: Egypt is one of the cheapest countries in the world in the cost and prices of goods and services in dollars. For example, Egypt is the second cheapest country, after Ukraine, in the world Big Mac index, which means measuring the price of buying a meal from McDonald’s in different countries of the world as per local prices. The cost of a meal in Egypt, after the liberation of the exchange, is approximately $1.7, which is 66% cheaper than its price in the United States. So, if you are a tourist using dollars or any currency of the 5 major currencies, you will find that Egypt is an ideal destination because you can enjoy quality services at a lower price. For example, the same meal in Switzerland is worth $6.7, in the US $5.8, in the UAE $3.8 and in Turkey $3.00.

Second: Egypt’s move to liberalise the exchange rate and to half the Egyptian pound’s value in the exchange market certainly helped Egypt’s tourism prospects, as $1 is now worth 18 pounds instead of 8.8 pounds.

The geo-strategic situations and its impact on tourism

First: We witnessed, a few weeks ago, the signing of the Palestinian reconciliation agreement in Cairo. It symbolised the Egyptian success that will have a profound impact on the imposition of greater stability and security in the North Sinai region and its continued negative impact on the image of Egypt as a whole. Therefore, the wise and intelligent move towards securing our borders and its security has a direct and substantial impact on the economy, especially in terms of tourism.

Second: Turkey is one of our main competitors in the Middle East tourism market, since the outbreak of the Gulf crisis, the Turkish line-up with Qatar has paved the way for the emergence of Gulf calls for Ankara’s tourist boycott, and thus Egypt is likely to benefit from this Gulf-Turkish tension. Although it is to be noted that Israel has, as well, magnified its promotional campaigns to advocate its tourism sector. Yet, with the competitive edge of Egypt’s resources, Egypt has the potential to stand competition along the year.

Third: The return of the Italian ambassador to Egypt and the restoration of relations, paves the way for attracting more Italian tourism, which is considered one of the most important markets for Egypt.

Fourth: Egypt’s success in combatting Hepatitis C in an innovative manner, opened the way for medical tourism expansion, which has already started through the international marketing campaigns, and utilising the low cost and entertainment equation in treatments making low cost packages of the treatment, accommodation, recreation, tourism and shopping compared to competitors in this the field.

Fifth: The Pope’s blessing for the Holy Family route through Egypt, greatly supports religious tourism to Egypt, and needs proper arrangements regarding tours setting and marketing.

Sixth: Bloomberg’s agency coverage to the opening of the Al-Futtaim Mall (Mall of Egypt) last March, gave a signal that Egypt has started promoting itself as a destination for shopping tourism. Which is an important factor in utilising our competitive pricing edge.

These projects ensure that we diversify sources of tourism revenue rather than rely solely on traditional tourism only, especially because Egypt is a touristic destination with the largest proportion of the world’s monuments and extended beaches, not to mention, beautiful weather all year.

There are strong expectations that the Egyptian tourism sector will recover due to the liberalising of the exchange rate, targeting new markets and a continuing continued political stability.

The latest news that supports these expectations

1- Hilton International Hotel Group plans to expand in Egypt after signing several contracts recently in Port Said

2- Mövenpick Hotels International Group strengthens its presence in Egypt with an expansion plan in the northern coast

3- The World Tourism Organisation puts Egypt in second place in its list of fastest growing tourist destinations this year

4- Tourism revenues for the first nine months in 2017 reached $5.3 billion, a growth rate of 211% over the same time last year, as revenues of 2016 in full reached $3.4 billion.

The report has shown that the future is bright for the Egyptian tourism sector and, with continued stability, the country will surely recover to its pre-revolution levels.