In an attempt to encourage bank customers to invest their money in the pound, two main state Banks, Bank Misr and the National Bank of Egypt, have released new saving certificates for Egyptian pounds with an interest rate of 12.5 per cent.

Views and concerns have been circulating since these certificates were issued. According to a credible source in one of the main national banks, several customers were eager to buy the newly released certificates especially that the average interest rate at Egyptian banks moves around 10 per cent. The main aim behind this step is encouraging Egyptians to invest in the pound and push them to sell dollars, in an attempt to support the local currency.

The certificates can be used as a guarantee in case the customer wants to obtain a loan, using easy terms, in addition to the chance of restoring the certificate’s value after six months from the buying date. The certificate can be bought from any of the bank’s branches nationwide.

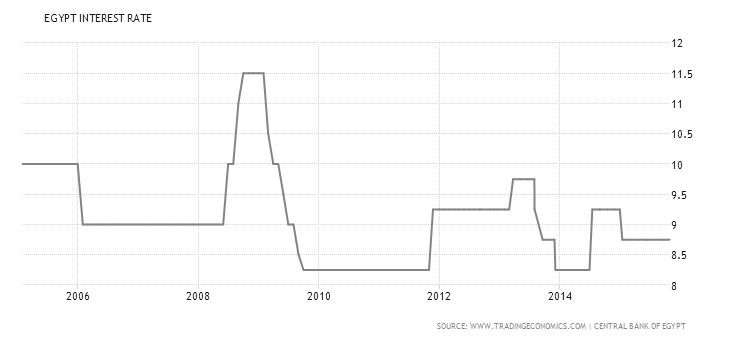

It is important to note that the interest rate in Egypt averaged 11.41 per cent from 1991 until 2015, and actually the 12.5 is considered a good raise. It is still negotiable if the step of issuing these high rate certificates, could help in solving the Egyptian pound crisis, which has weakened to 7.93 pounds against the dollar, during the last month.

While several bankers encouraged this step, many concerns were raised regarding investment opportunities in Egypt. While raising bank certificates can benefit bank customers, it might lessen the opportunities of other types of investments in Egypt, due to the withdraw of cash liquidity from the market.

“It is important to take into consideration, as well, the privates banks in Egypt” , an expert added. It is interesting to note that bank interests in Egypt reached its highest rate in October 1991 recording 21.40 per cent, and reached its lowest rate in September 2009, recording 8.25 per cent.