A persistent question circulated among the Arab and Gulf world: “Will there be an Arab Gulf common market”, following a report by Ernest & Young on economic growth drivers, entitled “Strength in unity”. It says that in case Gulf Cooperation Council (GCC) countries decided to become one big market, instead of 6 separate ones, it will emerge as the world’s 9th largest economy, equal to Canada and USA.

If the emerging GCC economy managed to maintain an annual growth rate of 3.2 per cent, over the next 15 years -till 2030- it will nearly be as big as Japan’s.

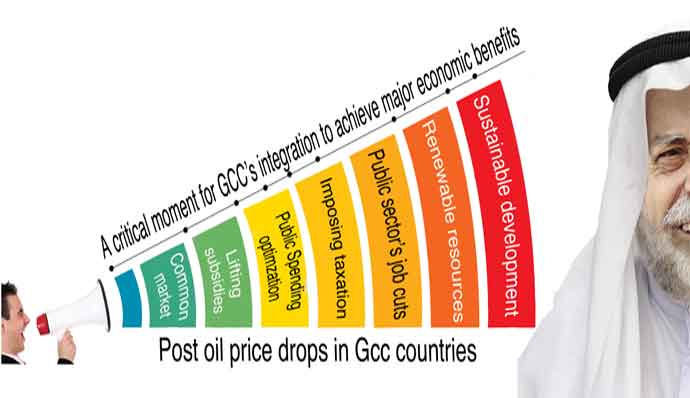

Gerard Gallagher, Managing Partner of Advisory Business of Mena Region at Ernst & Young, said that GCC governments are facing a crucial moment, seeing oil price drops. Thus, these countries must soon find new growth drivers that do not rely on oil revenues.

GCC countries are currently considering new options and decisions -like opening up their markets to foreign investors, lifting subsidies, imposing taxes, optimizing public spending and cutting public sector’s jobs.

Indicators show that a serious change started to be truly felt. These reforms could be more effective and less hindering, when it is part of a broader campaign toward developing a common GCC market. This will influence, in turn, economic diversification and boost private sector’s most productive areas, by sparking more competition and creating job opportunities.

Ernest & Young has developed an integration model to measure the economic effect of removing all barriers representing a stumbling block before trade, investment and production flow across GCC countries.

The study showed that this step towards integration can enhance their GDP by 3.4 per cent, i.e., $36m. Eliminating bureaucratic barriers represent 96 per cent of such growth. Yet, those who will benefit the most are Saudi Arabia, UAE, Oman and Bahrain -with a 3.5- 4.1 per cent increase in GDP.

The study highlighted that the next phase in GCC integration would require processing and facilitating change in 3 key sectors -namely trade, foreign investments and institutions.

The first includes developing customs federation into a modern common market that uses technology to ease business flow across the countries and optimizes long term spending.

The second involves simplifying and harmonizing foreign investment approaches and business ownership laws to broaden private sector and enhance its competitiveness.

Finally, the third is about developing GCC institutions, in order to keep the momentum going in markets and compete with private businesses.

All this would contribute in forming a common market that focuses on reducing public trade costs across GCC and boosts production and intra-trade. More importantly, for the long-run production levels will be much enhanced, due to the more flexible institutions, high efficiency levels, huge foreign investments and heated competition.

Future steps:

MENA Transaction Advisory Services Leader Phil Gandier said: “There are immediate steps GCC could take to optimize existing levels of cooperation, bringing significant economic gains to each of the member countries, while allowing them to focus separately on creating the incentives that will make them most attractive as investment locations.”

“Pinpointing and resolving these barriers might not sound like integration — but it would be a major step forward to leveraging the GCC’s common strengths to the benefits of each country”, Gandier added.

He said: “A first step would be to work with the private sector to identify the top ten barriers of doing business across the GCC. These would include specific obstacles at borders that slow the free movement of goods, outdated laws that don’t reflect the realities of the digital world and the multiplicity of regulations relating to business in each country that make compliance so hard for cross-border investors.”

It is worth mentioning that the most significant impact of GCC integration comes not from boosting intra-GCC trade, but from facilitating the region’s trade and investment relations with the rest of the world.

Creating a single market with the aligned foreign investment regulations would make it more attractive for global companies to vastly invest heavily in the GCC markets.