The Free Trade Agreement will open the doors of 25 countries to Egyptian products, writes Ahmed El-Mahdi

The events surrounding the grand launch of the Free Trade Agreement (FTA) that will bring 26 counties in the tripartite regional economic blocs into one common market will end today, after a presidential summit following three days of meetings between ministers of trade and senior officials.

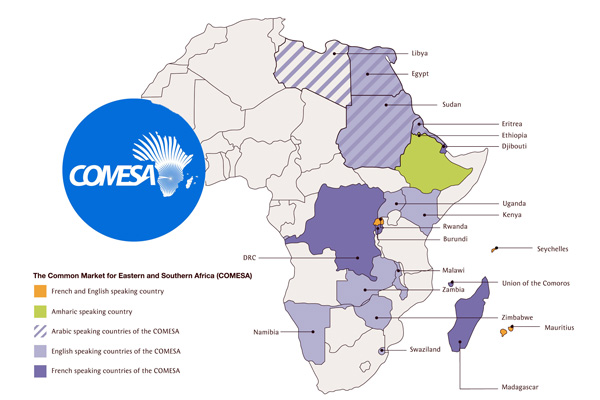

The Common Market for Eastern and Southern Africa (COMESA), Southern African Development Community (SADC) and East African Community (EAC), altogether comprising 26 countries representing 48 per cent of the members of the African Union, and holding 51 per cent of its Gross Domestic Product (GDP) and 56 per cent of its population, are to establish the biggest economic bloc in the region.

Businessmen have given an assurance that the agreement is coming at the right time for Egypt, particularly after the decline in its exports following the political turmoil in neighbouring countries which have resulted in losing some main export markets in Africa.

However, if the economy is to benefit from the agreement, a number of measures will have to be adopted beforehand. First, shipping to Africa should be supported by providing at least 50 per cent of the total shipping costs until a national shipping company is established. Second, there will need to be a swap system because of the difficulties in banking transactions in most African countries. Third, interest rates, which sometimes reach 16 per cent on the loans provided for financing new projects, will need to be lowered to attract new investments. This will increase productivity power and create new jobs. Fourth, it will be necessary to adjust the internal investment structure.

The benefit of this agreement to Egypt is conditional on the scope of internal reform of the investment climate, which requires setting a comprehensive strategy for the private sector to include a financial policy to help factories keep their production rates, says Magdi Tolba, former chairman of Readymade Garments Exports Council. He adds that intensive cooperation between government agencies and the private sector is highly needed.

The business sector is in acute need of new blood to enable fresh thought in solving the crises that threaten the industry and push away capital, Tolba says. He adds that economic growth is conditional on changing the current banking and monetary policies, which do not help existing factories to obtain finance unless through short term loans, not exceeding eight months, which are not complementary to the nature of the working factories.

Tolba says the government should help exporters reduce the costs of production, clarifying that there are no countries that wish to attract investment and impose high interest rates in addition to the high costs of utilities that have recently increased so rapidly. This piles new financial burdens on investors and pushes them away, he says.

He warns against failure when reforming the investment climate, adding that all the bilateral agreements signed with Egypt come in the interest of the other country and result in a defect in the balance of trade with those countries.

The chairman of Chemical Industries Exports Council, Walid Helal, told The Middle East Observer that this agreement was a good step towards enhancing future intra-trade between Egypt and African countries. This would be reflected in an increase in production in local factories, but it also required that the government adopt a number of incentive measures to encourage local exporters to increase their exports, he added.

The chairman of Chemical Industries Exports Council, Walid Helal, told The Middle East Observer that this agreement was a good step towards enhancing future intra-trade between Egypt and African countries. This would be reflected in an increase in production in local factories, but it also required that the government adopt a number of incentive measures to encourage local exporters to increase their exports, he added.

Exporters are demanding that the government set up a $500m. fund to ease export measures into the African market and enable exporters to complete the production process and continue exporting, Helal says. He points out that the capital cycle of some companies cannot bear waiting for four months to receive their dues from their African buyers, and adds that this fund would enable Egyptian exporters to obtain money from the fund without having to wait until the African importers transfer the money. The fund will be responsible for receiving the money from the importing companies at an interest rate lower than 2 per cent. Chinese traders have seen a leap in exports since they established a similar fund.

Helal asks that the government generalise the 50 per cent shipping support to Africa, adding that governmental monetary policies should be supportive of exporters, particularly when facing economic slowdown.

Regarding implementing the swap system when transacting with African countries, Helal said that it could be possible on one condition: if the government were in charge of its implementation.

By this agreement, Egyptian products will have free entry to fresh new African markets, says Magd al-Manzlawi, chairman of the customs committee at the Federation of Egyptian Industries. He adds that this will attract more foreign investors in the coming period and will certainly have a positive impact on the national economy because the number of importing markets will increase.

The chairman of Engineering Industries Exports Council, Khaled Ibrahim, called for implementing all the items in the agreement to ensure that Egyptian products had comparative advantages over other products. He pointed out that most of the countries that were members of blocs like COMESA were not obliged to implement the items of the agreements, nor to exempt Egyptian products from customs duties.

We are in a high need of an Egyptian company to be responsible for promoting our products in African markets and ensuring that products from a country like Kenya can move to other countries in Africa in order to enhance intra-trade, he adds.

He points out that last year’s engineering sector exports did not exceed 15 per cent of the total value of Egypt’s exports to Africa, amounting to $3bn. He expects, however, that the coming period will see a leap in Egyptian exports, particularly after the actual implementation of the agreement, because this will present an opportunity for our products to enter many African markets without customs restrictions.

Chairman of the Construction Materials Exports Council Walid Gamal al-Din told the ME Observer that the agreement was timely, particularly after the decline in Egypt’s exports of almost 25 per cent over previous years. Events in neighbouring countries have resulted in losing some active markets, such as Libya, in addition to the difficulty of obtaining foreign currency to import raw materials.

‘‘I expect exports will increase by10 per cent in the first two years after the agreement is implemented,’’ al-Din said, pointing out that the African markets were promising and could prove alternatives for the markets that have recently been lost. “This will be reflected in an increase in production and will provide lots of job opportunities,” he says.

There is a great opportunity to increase the volume of Egyptian exports to the 25 countries of up to $5bn over the next three years, compared with $2.7bn in 2013. This means there would be a doubling in exports by 100 per cent, Minister of Industry and Foreign Trade Mounir Fakhry Abdel-Nour said in a previous statement.

Egypt’s exports to the 25 countries represents 0.6 per cent of their imports. Exports to the three blocs amounted to approximately $2.7bn during 2013, compared with $3.1bn during 2012, a decline of $0.4bn. The major countries receiving Egyptian exports are Libya, Sudan, Kenya and South Africa, while imports to Egypt from these countries amounted to approximately $810m. during 2013, compared with $1bn during 2012, according to the Egyptian Commercial Service (ECS).

Egypt’s trade with its major trade partners of the 25 nations—notably South Africa, Libya and Angola—does not represent a great amount. The total Egyptian exports to these three countries amounted to $ 1.3bn—nearly 50 per cent of the total Egyptian exports to the whole of the 25. This represents a rate of 0.6 per cent of the total imports of these countries, which amounted to $196bn in 2013.

The total value of the exports of the 25 nations, excluding Egypt, amounted to $266bn during 2013. The most exported products are oil, precious stones, steel, and ships. China, Japan, India, Italy and the USA are the major importing countries of African goods.

The total value of the imports of the 25 countries, again excluding Egypt, amounted to $272bn during 2013. Machines, equipment, cars and electric tools were the major imported products. The major countries exporting to Africa are China, Germany, Italy, Turkey and the USA.

South Africa is ranks the first nation in regard to its trade volume. The total value of its exports amounted to approximately $95m. during 2014, compared with $90m. in 2013; an increase of $5m.

Its imports accounted to approximately $100m. during 2014, compared with $103m. in 2013; a decrease of $3m. Angola comes in second position regarding trade volume, with a total amount of exports of $64bn during 2013, and imports of $22bn.

Libya ranks third with a total value of exports of $42bn, while its imports amounted to $24bn during 2013.