1- This is the first decline to occur since 2010. This means that, for the first time Egyptian GDP has grown faster than debt growth. This means for the first time in 7 years we can overcome the bleeding of debt accumulation.

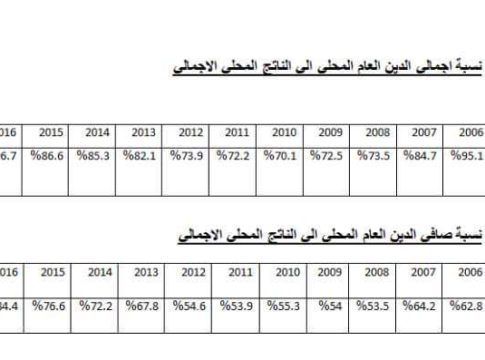

2- This is clear in the table above that we were achieving very good rates of debt reduction to output, and that we were about to reach the rates of safety before the revolution and the accompanying disturbances in 2011, and over time the rate of continuous rise, has served to delay and decline our progress.

3- GDP accelerated due to growth in exports and investment and their contribution to growth is more positive than before, after the liberalisation of the exchange rate.

4- The ratio of net public debt to GDP fell from 84.4% to 77.4%.

5- The net percentage is more important than the total and is the factor sought by economists, as is the difference between a company’s profit before tax and its profit after tax. Here comes the question / which is more important and accurate? The answer is Profit after taxes.

6- This net debt is the total debt less government deposits in the banking system.

7- There is no doubt that the ratio of net debt is still within the dangerous limits. However, the safe rate is at 60%, we are currently away by 17% between the global safe standard rate and our current stand. Any improvement towards reducing this difference means that we are heading in the right direction.

8- The reform programme and the loan agreement with the international Monetary Fund targets reducing the ratio of total debt to 85% by 2020, I think continuing with this performance will achieve the target easily.

9- External debt reached $79 billion, but the percentage to output is still at the safe border of 33%.

10- The Egyptian external debt cannot be considered dangerous for many reasons, including:

A-Short-term debt is $12.2 billion, while the average and long-term debt is $66.7 billion. Of course, short-term is the most important, which is not alarming if we take into account our recent history of payment that proves our comittment.

First: $ 6 billion was paid to Qatar out of its total $7.5 billion in 18 months (between June 2013 and December 2014).

Second: 50% of the foreign oil companies’ debts totaling $6.5 billion were paid in 24 months (between July 2014 and July 2016).

Third, $17 billion of foreign liabilities were repaid in 11 months (between November 2016 and October 2017).

Fourth, if we assume that there is a dollar-denominated company, then we expect it to make substantial investments also in US dollars, not in local currency. Is this easily achievable?

Yes, we have seen for the first time that the Egyptian government is investing in dollars in US treasury bills.