By: Ahmed Ouf

The Monetary Policy Committee (MPC) affiliated with the Central Bank of Egypt (CBE) will meet on Thursday Feb 16th, to take a decision concerning the future of interest rates in CBE.

In this context, “Pharos Research” expects that the Monetary Policy Committee will maintain the interest rates unchanged.

“Pharos” declared in a recent research note that the costs of raising the interest rates outweigh the potential benefits during the current period, which supports the CBE to keep the interest rates at current levels, despite rising inflation.

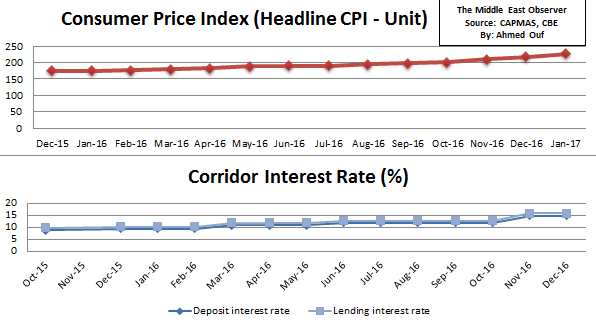

The Central Agency for Public Mobilization and Statistics (CAPMAS) declared that the country’s Consumer Price Index (headline CPI), reached 227.5 units by the end of January 2017, up from 218.1 unit in December 2016, with an increase of 4.3per cent.

CAPMAS added that the annual change in the headline CPI in January reached 29.6per cent, up from 24.3per cent in December 2016, with an increase of 5.2 percentage points.

The CBE raised the interest rates by 300 basis points (3 percentage points) on November 3rd . The overnight deposit and lending rates have been raised to 14.75 percent and 15.75 percent respectively. This increase came in conjunction with the floatation of the Egyptian pound exchange rate.

Law No. 88 , year 2003 of the Central Bank, Banking Sector and Monetary System, entrusts the Central Bank of Egypt to formulate and implement the monetary policy, with price stability being the primary and overriding objective. The CBE is committed to achieving, over the medium term, low rates of inflation, which are essential for maintaining confidence and sustaining high rates of investment and economic growth.

To control the inflation, the CBE uses the corridor system, which uses the overnight deposit and lending rates between CBE and other banks, which is determined by the Monetary Policy Committee. It is to be noted that the corridor system affect market liquidity, which by its turn result in market inflation.