Emerging markets pay for quantitative expansion of global banks’ policies

Situation to worsen if US Fed raises interest again

Sayed Aweidi, a global money markets analyst and head of technical analysis at T-Matrix Company, said that the current period witnesses the transmission of the global financial crisis that occurred in developed markets in 2008 to the emerging markets. This crisis will reach all economies and affect economic growth rates, as emerging markets, mainly China, are the largest consumer worldwide.

In an exclusive statement to the Middle East Observer, Aweidi said that the economic problem is -for the time being- in emerging countries, while the 2008 global crisis hit developed markets. The crisis was followed by US Federal Reserve and other central banks’ -whether in Japan or England- entry in the expanding quantitative easing policies. Which have resulted in the transfer of stumbling funds to emerging markets through the global central banks’ debt purchase of faltering companies and re-pumping cash into the market.

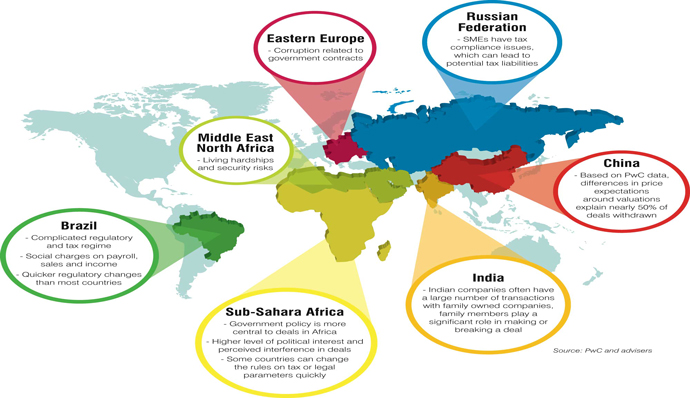

He added that cash was moved into hedge funds, through which bonds of emerging countries (China, Brazil, South Africa and Turkey) were bought and therefore, the cash pumped by developed countries went to emerging markets. Hedge funds used assets they owned for borrowing, and so emerging markets debts rose. The borrowing at that time and the purchase of funds of emerging bonds was encouraged by the low US interest rates’ proximity to zero.

He asserted that the interest rate’s decline encouraged hedge funds to purchase bonds in abundance from emerging markets, in light of the interest rates ranging between 1 and 2 per cent, which is considered low for emerging markets but represent a profit to funds that borrow from the global central banks -with interest rates of around 0.25 per cent.

He pointed out, the problem of China is not a domestic one, but a problem of a decreased global demand. Its products are the same and their prices have not changed, and therefore, companies’ profits started to decline, due to inflation and the rise of debt rates from time to time and that was where China’s problem began.

He pointed out that China is the largest oil consumer worldwide, and in light of demand for China’s products and its inability to sell its products, demand for energy, oil and raw materials drastically dropped.

He stressed out, the crisis in emerging markets will continue for a long time, it is not just a 2016 issue, as it would be increased if the US Federal Reserve raised interest rates again.

“We are currently witnessing the transition of the 2008 global financial crisis in developed markets, into emerging markets, as it will consequently hit global markets and affect rates of economic growth. The emerging markets, mainly China, is among the biggest consumers in the world,” he said, noting the abundance in supply whether energy or raw materials -the greater the supply, the more drops in prices occur.

He explained that China had focused in the past on manufacturing and conquering the world markets, but it discovered that its products are not widely sold, thus it decided to focus currently on the domestic consumption -through selling its products at its local markets- especially in light of the great increase in population. This would lead to price hikes if products are not widely available, therefore China is experiencing an economic change that would not likely to have positive impacts before 4 or 5 years.

Global reports revealed that emerging countries, especially countries of the BRICS bloc, witness an exit of funds in the meantime, and this is expected to increase in the coming period. Especially with reference to the meeting of US Federal Reserves next month, which now seems likely to score another increase US interest rates -rates that have been stable over the course of previous decade’s global markets.