Since 2014, our region has undergone radical changes in the composition and components of economies, from the oil-rich Gulf through Egypt to the Maghreb countries.

In this article we will present the experiences of radical economic reforms in the Arab countries, linking them to the Egyptian experience and the prospects for these changes and restructuring for impacting the future of the region. The beginning will be from news that we followed two weeks ago:

“Jordan raises taxes on several goods, reduces subsidies on other goods”

First: Jordan

Timeline of file reforms in Jordan

1. The beginning was when the Executive Board of the IMF approved in August 2012 Jordan's request for a three-year extended agreement that would provide a funding of $ 2 billion.

2. In August 2015, Jordan renews this agreement with a funding of US $ 723 million.

3. Thus, total loans of the Jordanian Fund since the beginning of the government's request in 2012 so far is $ 2.7 billion.

Why did Jordan ask for help from the Fund?

1. The Continuing chaos of war on the borders of Amman (Syria and Iraq) is a main factor. Despite the defeat of Daesh in Iraq late last year, the negative impact is still in effect so far and Jordan needs many years to recover from it

2. The unemployment rate rose from 11.9% in 2014 to 15.3% in 2016

3. Economic growth fell from 3.1% in 2014 to 2.3% in 2016

4. The trade balance deficit continues at $ 10 billion

5. The chaos and war have severely affected Jordan's foreign investment inflows and the entry of international financial institutions into the market. Foreign investment flows dropped from 5.8 billion dollars in 2014 to 4.8 billion dollars in 2017.

6. Public debt to GDP rose from about 85% in 2014 to 95% in 2016.

7. One of the biggest weaknesses is that foreign grants from Jordan's sister countries account for about a quarter of the public revenues or about 5% of GDP until 2016

Meaning that the Jordanian budget deficit will increase by 5% if we exclude these grants or if they are stopped for any reason, bearing in mind that most of them come from the Gulf countries who are suffering from the low oil prices and applying as well major reforms and this is what we will review in the second part of the article.

Advantages of the Jordanian Reform Program

1. This program is based on a national program (not a foreign reform program) developed by Jordan under the name of Vision 2025 (similar to Vision 2030 in Egypt)

2. The reforms aim to create better conditions for achieving the growth of the larger segments of the population while protecting the poor (similar to the interdependence and dignity project in Egypt)

3. Jordan has been able to make progress in the energy sector (especially the abolition of fuel subsidies to be replaced by direct cash transfers to the poor) and succeeded in restoring an adequate level of reserves in the Central Bank.

Despite the successes, Jordan still faces major challenges:

Economic growth is still below the required level, unemployment is rising and the refugee crisis continues to be a burden on the economy

As a result of the above and to promote the success of economic reform and market regulation efficiently, The government raised taxes last January on a number of goods to cut expenses and increase revenues, all with the aim of reducing the budget deficit and maintaining the integrity of the economy

One of the advantages we observe is that protests are becoming weaker, which is a great thing that minimises the risks surrounding the reform process, and an opportunity that the government continues its serious steps and procedures, with attention to the vulnerable groups who are mostly affected by these measures, to ensure success of its efforts.

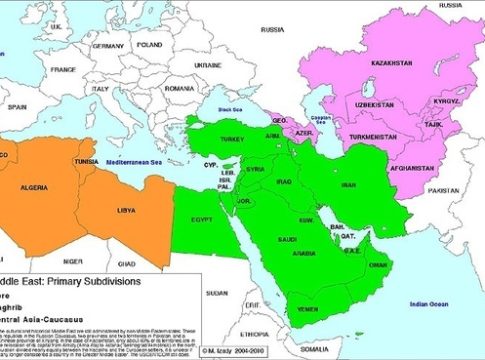

Second: Economic reforms in the Arab countries

These countries are divided into two parts:

1. The Arab countries that started with the economic reform and requested the assistance of the International Monetary Fund and the various international institutions

• Egypt - $ 12 billion ($ 6 billion has been disbursed so far)

• Tunisia - $ 2.9 billion ($ 1 billion has been disbursed so far)

• Jordan - $ 1.3 billion + $ 723 million = $ 2 billion ($ 1.4 billion has been disbursed so far)

• Morocco - $ 12 billion (Morocco's economy has been stable and strong and so far no cash support from the IMF has been needed so far)

2. The Arab countries that started with the economic reform but did not request the assistance of the International Monetary Fund and the various international institutions

Sudan

The country could not seek assistance due to international sanctions and embargoes, but the situation of Sudan in brief is as follows:

A) Raising prices of fuel and basic services in December 2017

B) The exchange rate was partially released from 6.7 Sudanese pounds to 18 pounds and then in February this was reduced again to 31.5 pounds (Officially). However, in the black market, the price ranges between 37-42 pounds per 1 dollar (and growing wider).

C) Khartoum is not expected to emerge from its crisis as it neither a clear plan, nor the financial resources.

D) In addition to the corruption and indiscriminate economic policies, political instability and internal wars that have continued since the secession of the south and the loss of the bulk of oil production and exports

E) Sudan urgently needs international intervention but before that the country needs to adjust and set its policies on a proper reform track.

Gulf States: Saudi Arabia, UAE, Kuwait, Bahrain, Qatar and Oman

Why did not the Gulf countries request assistance from the Fund and others?

Because it has sufficient resources to finance its reform due to the abundance of resources and reserves generated by industries associated with oil, gas and petrochemicals.

Why does the Gulf need economic reform?

The drop in oil prices in 2014 from about 120 dollars a barrel to 30 dollars and then 50 dollars in 2015 and 2016 and currently 70 dollars, alerted the Gulf countries, towards diversifying its financial resources, and had to impose austerity and implement reforms in order to protect the economy from any potential risks due to changes in the price of oil that remains the main source of revenue in the budgets of these countries.

The size of the Gulf capabilities:

* Cash reserves in Gulf central banks are $ 675 billion

* Sovereign wealth funds in the Gulf are worth $ 3 trillion, accounting for 40% of the world's total sovereign wealth

* The Gulf countries also imposed a variety of new taxes, such as a value added tax of 5% and a selective tax on soft drinks by 100% and raised the price of fuel at different rates and increased prices of several services to diversify income.

* Saudi Arabia, for example, has sought to attract investments in industry and services to avoid dependence on oil and protect the economy from fluctuations in the global market. Along with launching major new projects like "NEUM" City by the red Sea.

* Qatar on the other hand, borrowed foreign funds as an alternative to borrowing from the IMF; the country issued foreign bonds worth $ 9 billion in 2017. Another request will be made at the same value this year. Qatar’s foreign debt reached more than $ 200 billion, as per Moody’s May 2017 report.

In Conclusion

After this brief and quick presentation of what is happening in our region, when we examine these harsh and difficult measures by sister countries, we recognise the importance and necessity of measures taken by the Egyptian government, especially when we note that some of these economies that implement austerity and reform are basically rich economies. Yet the path of reform is inevitable and not a luxury.

Within the next 5 to 7 years, assuming that the Arab governments remain steadfast in these difficult and austerity measures, the shape of the region will change dramatically; communities and individuals will suffer in the beginning, but the sustainability of the economies will increase, which will positively affect the stability of the whole region and become an attractive environment for investment rather than a repellent. A safe environment, reversing the previous situation of terrorism, chaos and revolutions, will ultimately reflect a decent life for individuals; improve living standards, providing jobs, services and facilities suitable for the people of our region.

BY : Mohamed Negm